9712734028 How to Invest in Dividend Stocks for Passive Income

Investing in dividend stocks for passive income requires careful selection of resilient companies with a consistent history of dividend payments and strong financial health. Analyzing key metrics such as payout stability, growth trends, and sustainability is essential for long-term success. Employing strategic approaches like dividend reinvestment and diversification can optimize returns while managing risks. Understanding tax implications further enhances income potential. The process involves nuanced decision-making that can significantly impact financial independence objectives.

Choosing the Right Dividend Stocks

When selecting dividend stocks, investors must prioritize a combination of consistent dividend payments and strong financial fundamentals.

Analyzing dividend payout stability alongside accurate stock valuation ensures sustainable income streams. This approach empowers investors seeking financial independence by focusing on resilient companies capable of maintaining dividends, thus optimizing long-term passive income without unnecessary exposure to high-risk investments.

Analyzing and Evaluating Dividend Stocks

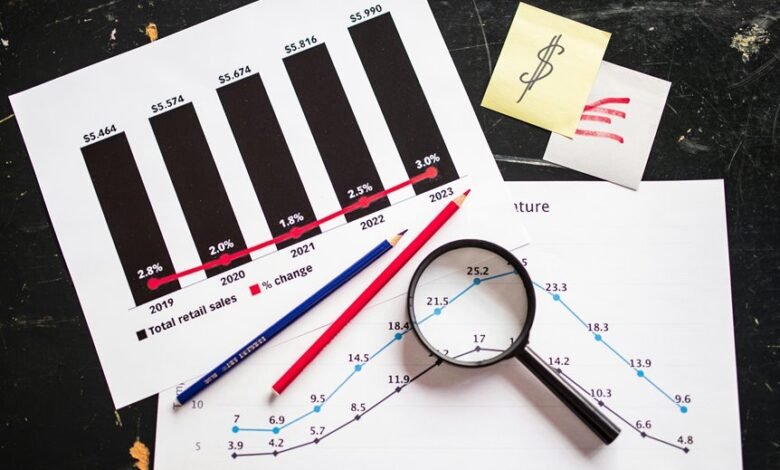

Evaluating dividend stocks requires a systematic approach that combines quantitative analysis with qualitative judgment. Key metrics include dividend growth trends and sustainable payout ratios, which indicate financial stability and long-term viability.

Analyzing these factors allows investors to identify resilient stocks capable of providing reliable passive income, aligning with their desire for financial independence and strategic control.

Strategies to Maximize Your Income From Dividends

To maximize income from dividends, investors must employ strategic approaches that enhance yield without compromising financial stability.

Dividend reinvestment compounding growth, while understanding tax implications, ensures optimal after-tax returns.

Balancing these strategies enables investors to amplify passive income streams, fostering financial independence and freedom without risking overexposure or unintended tax burdens.

Conclusion

Mastering dividend stock investments requires meticulous analysis and strategic planning. By selecting resilient companies with proven payout stability and employing diversification alongside dividend reinvestment, investors can craft an income stream that rivals the most powerful financial engines. Understanding tax implications further fine-tunes returns. When approached with discipline and precision, dividend investing transforms ordinary portfolios into an unstoppable force—an income powerhouse capable of sustaining financial independence and weathering any economic storm.